Finding the right credit monitoring service for you in 2023 is easier than you think.

Credit monitoring is an important tool that helps you protect your financial health.

Finding the right one that fits your needs can be difficult with many different services available.

In this article, we will look into what credit monitoring is, discuss the potential benefits of using such a service and give tips on evaluating and selecting the best credit monitoring service.

What is Credit Monitoring?

Credit monitoring services are designed to help people better manage their financial health by providing them best free credit monitoring and with access to their credit reports and scores.

These services send notifications when there are any changes or attempts to open new credit accounts made in their name so they can take action accordingly.

Additionally, some services offer additional features, such as identity theft protection and coaching programs to help users improve their credit scores and manage their finances more effectively.

Benefits of Using a Credit Monitoring Services

Using a credit monitoring service has numerous advantages. It can provide peace of mind that someone’s personal information is secure through alerts if suspicious activities are on their account.

This helps individuals identify fraud quickly before it causes major damage to their finances or reputation.

In addition, tracking your credit score over time could assist in making decisions regarding debt repayment plans and loan applications, minimizing bad debts or late payments.

Furthermore, many services offer additional features such as budgeting advice, education materials, and identity theft insurance that can give users greater control over managing their finances long-term.

How Do You Pick The Right Credit Monitoring Service?

There are a few things to consider when looking for a credit monitoring service.

You should think about the price and how you will be billed. It is also important to consider how easy it is to get help from the company if you have questions.

You might consider if the company offers access to all three major credit bureaus, offers different alerts, and provides extra resources for credit monitoring alerts or tools.

You should also find out how long it will take to set up the account and start using it. Finally, you might want to see if the company offers a free trial period.

Tips for Picking The Right Credit Monitoring Service For You

The first step when selecting a quality service is researching different providers so you can make an informed decision based on your specific needs and budget.

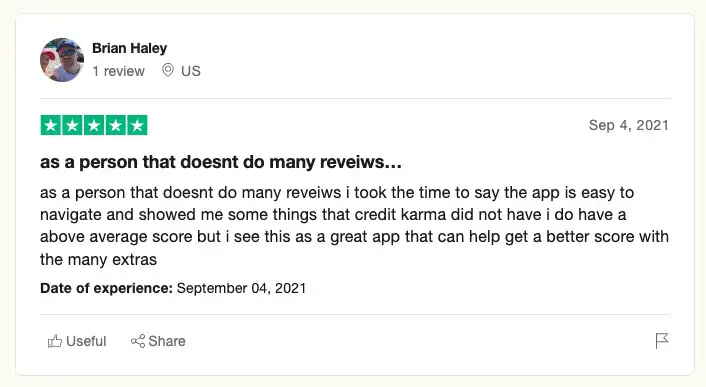

Take some time to compare various company features and read customer reviews online to determine which offers the most value for your money.

Once you have narrowed down your choices, be sure to check out the terms & conditions thoroughly before signing up with any particular provider.

Some require long-term contracts with cancellation fees if you decide later down the road that it isn’t working out or if something better comes along during that time.

It may be ideal for switching over without having those additional charges attached, then doing so within grace periods necessary under certain state laws depending on what country/region you reside in.

SmartCredit | $1 (7-Day) Trial | $34.95/Month | Visit Website

4.9 out of 5

If you’re looking for a way to take charge of your credit score, you can’t go wrong with SmartCredit membership!

The average SmartCredit member sees an increase of 61 points within 20 days according to SmartCredit.

SmartCredit also has an a.i.-like feature that analyzes your credit report, finds inaccuracies, and gives you ACTION BUTTONS to dispute, request goodwill forgiveness, address errors, and much much more!

In addition, SmartCredit gives you a Smart Money Manager, $1M Privacy and Fraud Insurance, Dark Web monitoring and more.

If you want to peg your score against the “big three” bureaus, TransUnion, Experian, and Equifax Access are right there at your fingertips, too – it couldn’t be easier.

So get ready to give your credit score the ultimate upgrade.

Start Your 7-Day Trial For Just $1!

Pros

- 3 Bureau Reports

- 3 Bureau Scores

- Credit Alerts

- $1M Fraud Insurance

- Money Manager + More Features

- Takes Any Credit, Debit, or Prepaid Card

Cons

- Vantage 3.0 Scores Only

- A tad pricier than other competitors

- Mobile app needs improvement

MyScoreIQ | $1 (7-Day) Trial | $34.99/Month | Visit Website

4.8 out of 5

MyScoreIQ is an incredible service that can help people stay on top of their credit score in today’s economy. Not only are their plans reasonably priced, but they offer up to three-bureau credit reports and FICO® Scores along with a handy FICO® Score tracker tool and FICO® Score simulator, so you can have visibility over your financial situation. Plus, you get daily credit report, basic credit monitoring services and identity theft protection for additional peace of mind. And if you have any questions, customer service is available from their US-based team to provide support whenever you need it. Saving going into 2021? MyScoreIQ is definitely the way to go!

Pros

- 3 Bureau Reports

- 3 Bureau FICO Scores

- Credit Alerts

- $1M Identity Theft Insurance

- See Consumer, Auto, Mortgage, Credit Card FICO Scores

Cons

- No Vantage 3.0 Scores

- Priciest Option

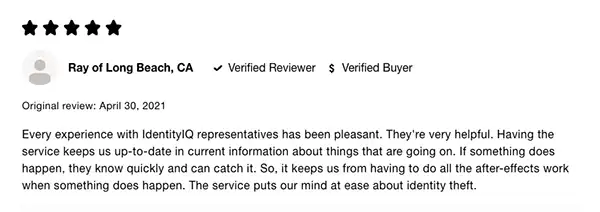

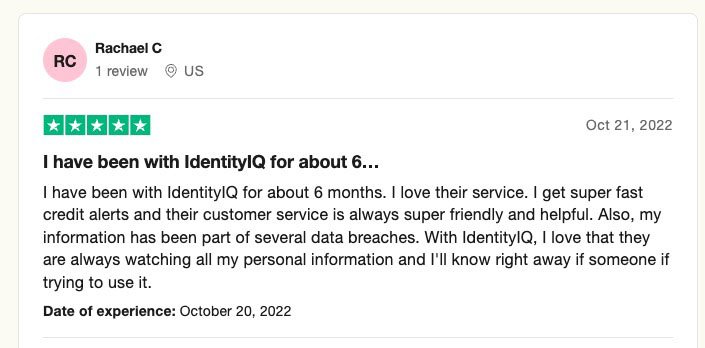

IdentityIQ | $1 (7-Day) Trial | $30.99/Month | Visit Website

4.7 out of 5

Have peace of mind with IdentityIQ! With their data and identity protection service plan, your identity is monitored around the clock, and you can even track the activity of your loved ones at no extra cost.

But the benefits don’t stop there!

You can also count on a million dollars in data to prevent identity theft, insurance, dark web, most credit monitoring services, and lost wallet recovery.

Enjoy all these features, lawyer coverage just in case, checking your account balances to monitor credit reports, and a US-based customer service team – so cute that they even have a Do-Not-Call list opt-in and junk mail opt-out.

How cool is that?

Get onboard with IdentityIQ for total privacy and identity protection tools, plus file-sharing activity tracking for an added security layer.

Don’t wait until you become a victim to act – get your identity safe now with IdentityIQ!

Pros

- 3 Bureau Reports

- 3 Bureau Scores

- Credit Alerts

- $1M Stolen Funds Reimbursement

- $25K Identity Theft Insurance

Cons

- Vantage 3.0 Scores Only

- Only Takes Major Credit Cards or Debit Cards (No Chime, CashApp Card, or Prepaid Cards)

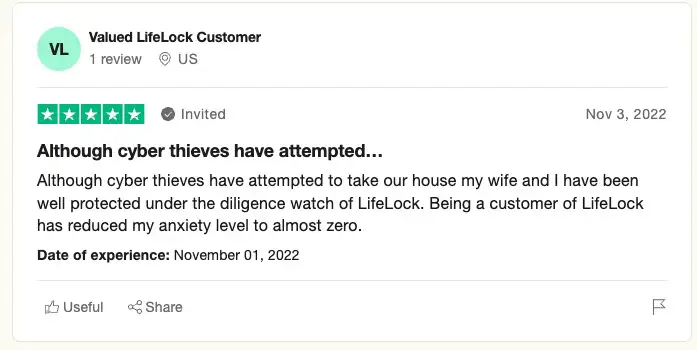

LifeLock Identity Theft Protection | Plans Starting at $8.99/Month | Visit Website

4 out of 5 Stars

If you want to guard your identity like Fort Knox, consider purchasing Lifelock Identity Theft Protection Services.

Don’t take unnecessary chances with your sensitive information, and guard it the smarter way.

Check out the different tiers of identity protection services LifeLock has on offer.

You can get paid credit monitoring services at Equifax, dark web surveillance, change of address verification processes, and in some cases, up to 25k in stolen funds reimbursement.

Plus, the introductory rate begins at just $8.99 per month, and renewal can be done for $11.99.

Bada-bing bada-boom!

Now that’s serious identity protection made easy and affordable!

Pros

- 3 Bureau Reports

- 3 Bureau Scores

- Credit Alerts

- Up To $1M Insurance For Lawyers and Experts

- $1M Stolen Funds Reimbursement

- Home Title Monitoring and More

Cons

- Vantage 3.0 Scores Only

- Best Features Reserved For Pricier Plans

- Price Increases After First Year

- No Trial

Conclusion: Choosing a Credit Monitoring Service That Fits Your Needs

Finding the right credit monitoring service can prove beneficial when it comes down to managing personal finances more efficiently while helping protect against identity theft.

In an increasingly digital world where one’s personal information might be compromised without him/her even being aware of it.

Taking fast action if you fall victim to identity theft can be the difference between a short-term inconvenience or a long-term headache.

Ultimately though, with all these things considered, finding the right credit monitoring service for you comes down to your needs and budget.

Really, as long as you pick something, you’re a step ahead of most people.

Credit Monitoring Service FAQ

What credit tracker is the most accurate?

There are several widely-used credit monitoring services available, and most of them offer accurate credit scores. However, it’s important to note that the credit score you see might vary depending on the scoring model used (like FICO or VantageScore), the credit bureau data it’s based on (Experian, your TransUnion credit report, or your Equifax credit report), and when the information is updated.

Here are a few highly regarded and used credit card fraud and monitoring companies and services:

- Experian: As one of the three major credit bureaus, Experian’s credit monitoring service provides an accurate and reliable credit score, based on their own data. They offer a range of services, from identity theft protection to FICO score tracking.

- TransUnion: Another one of the three credit bureaus, TransUnion’s credit monitoring services also offer reliable and accurate credit score information, based on their own data.

- Equifax: The third major credit bureau, Equifax, offers a comprehensive credit monitoring service, complete with access to your Equifax credit score and report.

- Credit Karma: Credit Karma provides free credit score and report information from TransUnion and Equifax, using the VantageScore model. They update the information weekly.

- myFICO: This service offers credit monitoring and access to your FICO scores from all three credit bureaus. As FICO is the scoring model most commonly used by lenders, this can give you a good idea of what lenders will see.

- SmartCredit: The latest in A.I. technology providing real time action steps that help it’s users boost their credit scores by 61 points within 20 days on average.

Remember, it’s always a good idea to regularly monitor your credit score and report from all three bureaus, as the data each bureau has can vary. This can help you catch any inaccuracies or signs of fraud.

Which of the 3 credit reports is best?

The three main credit reporting bureaus in the United States are Experian, TransUnion, and Equifax. Each collects information about your credit history, such as your payment history, the amount of debt you have, the length of your credit history, and more.

There isn’t necessarily a “best” report among the three main credit bureaus. All three provide crucial information and they are all used by lenders and creditors. Here are some factors to consider:

- Coverage: While these agencies generally collect similar types of information, not all lenders report to all three credit bureaus, so your reports could vary between them. This means that a score from one bureau might not be exactly the same as a score from another.

- Accuracy: All three bureaus have processes in place to ensure the accuracy of their reports, but mistakes can occur. Regularly checking all three reports can help you spot and correct errors.

- Credit Score Models: Credit bureaus can use different scoring models to calculate your credit score. For example, Experian uses the FICO 8 and FICO 9 models, among others. TransUnion and Equifax use VantageScore in addition to FICO. Different lenders might prefer one model or bureau over the others.

- Access: All U.S. consumers are entitled to a free credit report from each of the three bureaus once every twelve months through annualcreditreport.com. Due to COVID-19, however, access has been increased to weekly through April 2022. Some credit monitoring services also provide more frequent access to your credit report from one or more of the bureaus.

In summary, it’s recommended that you check your credit reports from all three bureaus regularly to ensure accuracy and to get a complete picture of your credit health. The “best” report will depend on your individual circumstances and the specific information that each bureau has about you.

What is the best way to monitor your credit?

Monitoring your credit can help you keep track of your financial health, catch errors, and detect signs of identity theft. Here are a few methods to effectively monitor your credit:

- Annual Credit Report: U.S. federal law mandates that each of the three main credit bureaus (Experian, Equifax, and TransUnion) provide you with one free credit report each year, which can be accessed at www.annualcreditreport.com. During the COVID-19 pandemic, access has been temporarily increased to weekly reports through April 2022.

- Credit Monitoring Services: These services can provide more frequent access to your credit reports, and often offer additional features like credit score tracking and alerts for changes to your credit files. Some well-known services include Credit Karma, Credit Sesame, and myFICO. Some of these services are free, while others require a monthly subscription.

- Bank and Credit Card Issuers: Many banks and credit card issuers offer free credit score access to their customers, typically updated on a monthly basis. This score is usually from one bureau and based on one scoring model, so it’s not a complete picture, but it can be a useful tool for tracking your credit over time.

- Identity Theft Protection Services: These services monitor your credit files and other personal data to detect potential signs of identity theft. Some also offer access to your credit reports and scores. Examples include LifeLock and Identity Guard.

- Credit Locks and Credit Freezes: These can prevent unauthorized access to your credit reports, which can stop identity thieves from opening new accounts in your name. A credit lock can typically be lifted online instantly, while a credit freeze requires a bit more effort to lift. You can place a freeze for free with all three credit bureaus.

- Fraud Alerts: If you’ve been a victim of identity theft, you can place a free fraud alert on your credit reports which notifies potential creditors that they must take extra steps to verify the identity of anyone trying to open an account in your name.

It’s also a good idea to check your financial accounts regularly for any unauthorized transactions. If you see something suspicious, report it to your bank or credit card issuer immediately.

While the frequency of monitoring can vary based on your individual needs and concerns, regularly checking your credit can help you maintain a good credit score, correct inaccuracies, and respond to signs of identity theft quickly.

Is Experian more accurate than Credit Karma?

The difference between Experian and Credit Karma isn’t so much about accuracy, but about the source of their information and the credit scoring model they use.

Experian is one of the three main credit bureaus, along with Equifax and TransUnion. These bureaus collect credit information directly from lenders and creditors, and they use this information to calculate credit scores using a variety of models, the most commonly used of which is FICO. Experian thus provides an Experian-based FICO score, which is widely used by lenders.

On the other hand, Credit Karma provides credit scores based on the VantageScore 3.0 model from TransUnion and Equifax data. The VantageScore model was developed as a competitor to the FICO score and is used by some lenders, though FICO is more commonly used.

So, all credit scores you see, whether from Experian or Credit Karma, are accurate in that they accurately represent the calculations made based on the various credit bureaus monitored the data available to them. But they might differ because they’re based on different credit scoring models or data from different credit bureaus.

Furthermore, different lenders use different scoring models or might pull your credit data from different bureaus. For example, a lender might check your FICO score based on Experian data, while another might look at your VantageScore based on TransUnion data. As a result, none of these scores is definitively “more accurate” than another. They’re just different ways of interpreting your credit data.

The most important thing is to use these scores as a general guide to your credit health and to monitor your credit regularly for any changes or potential signs of fraud. And remember, the specific numbers aren’t as important as consistently practicing good credit habits, like paying your bills on time, keeping your credit utilization low, and applying for new credit only when necessary.

Free Credit Monitoring Service: How far off is Credit Karma from your actual score?

Credit Karma provides VantageScore 3.0 credit scores, which are based on data from the TransUnion and Equifax credit bureaus. These scores are indeed “actual” credit scores, but they may differ from the FICO scores that many lenders use in their decision-making processes.

There are several reasons why your VantageScore from your Credit Karma account might differ from your FICO score:

Different Scoring Models: VantageScore and FICO use different algorithms to calculate your credit score, so your scores might vary even if they’re based on the same underlying credit report.

Different Credit Reports: Your credit reports from TransUnion, Equifax, and updated Experian credit report might not be identical. Lenders don’t always report to all three bureaus, or they might not report to all three at the same time. So if your FICO score is based on your Experian report, for example, it might differ from your VantageScore based on your TransUnion or Equifax report.

Timing: Your credit scores can change over time as new information is added to your credit reports. If your VantageScore and FICO score are calculated or updated at different times, they might show slightly different results.

The discrepancies between Credit Karma scores and the ones used by potential lenders can sometimes be significant, depending on these factors. It’s not uncommon for there to be a difference of 20-30 points, though the discrepancy can be smaller or larger. That’s why it’s recommended that you check your credit scores from a variety of sources, especially if you’re preparing to apply for a major loan like a mortgage.

However, keep in mind that regardless of the scoring model used, good credit habits — like paying your bills on time, keeping your credit utilization low, and applying for new credit only when you need it — will positively impact all of your credit scores. So focus less on the specific credit score model, and more on maintaining good credit behavior.

Do banks use TransUnion or Equifax?

Banks and other lenders may use credit reports from any of the three major credit reporting bureaus: Experian, TransUnion, and Equifax. Some lenders may even use reports from all three. The choice of which bureau’s data to use can depend on a variety of factors, such as the lender’s relationship with the bureau, the specific type of loan, and regional considerations.

Moreover, banks not only look at the credit reports but also consider the credit scores calculated based on those reports. The two main types of credit scores are FICO scores and VantageScores. FICO scores are used in over 90% of U.S. lending decisions. While many free credit monitoring services provide VantageScores, most banks still use FICO scores when making lending decisions.

In terms of which credit score simulator is most important for you, it really depends on what type of credit or loan you’re seeking, and the specific practices of the lender you’re dealing with. If you’re seeking a mortgage, for example, your lender will likely use a version of the FICO score model that’s specifically designed for mortgage lending.

Remember, it’s a good idea to check your credit reports from all three bureaus regularly to ensure accuracy, as the information each bureau has can vary. Under U.S. law, you’re entitled to one free report from each bureau per year through AnnualCreditReport.com. Due to the COVID-19 pandemic, the bureaus are offering free weekly online reports through April 2022.

Can I trust Experian?

Experian is one of the three major credit bureaus in the United States, along with Equifax and TransUnion. It’s a legitimate and widely recognized company that collects credit information, creates credit reports, and calculates credit scores.

In terms of trusting the accuracy of major credit reporting agencies the data they provide, the Experian credit file, like all credit bureaus, aims to provide accurate information. However, errors can occur, which is why it’s important to regularly check your credit reports from all three bureaus. If you find any inaccuracies in your Experian credit report, you can dispute them directly with Experian, who is legally obligated to investigate and correct any validated errors.

In terms of data security, Experian has measures in place to protect your information. However, like any company, it can be susceptible to data breaches. In 2015, Experian suffered a significant data breach that affected approximately 15 million people. Since then, Experian has made efforts to improve its security measures, but it’s always a good idea to regularly check your credit reports and financial accounts for any signs of suspicious activity.

Experian also offers credit monitoring and identity theft protection services, which can provide additional protection. However, whether to use these services is a personal decision that depends on your individual needs and circumstances. Be sure to understand the terms and costs of these services before signing up.

In summary, while Experian is a trusted and widely used credit bureau, it’s important to regularly monitor your credit and be proactive in protecting your personal information.