Have you ever wanted to get an overall picture of your financial health but felt overwhelmed by the process?

If so, then a smartcredit com reviews is just the resource you need!

With a comprehensive credit check and report, SmartCredit can help you stay on top of your finances and work towards obtaining a higher credit score.

Whether you’re looking for debt management advice or want to understand more about how credit works, SmartCredit has everything users need within their platform.

Read this review to see why so many users trust SmartCredit with managing their personal finances.

An introduction to Smartcredit com and what they offer

Are you looking for a smart way to manage your finances?

Look no further than Smartcredit.com!

This innovative company offers a variety of tools to help you stay on top of your credit score, track your spending, and monitor your identity.

Plus, their user-friendly website makes it easy to navigate and understand all your scores and financial data.

Whether you’re trying to improve your own credit history or simply want a better understanding of your finances, Smartcredit.com is the way to go.

Say goodbye to overwhelming spreadsheets and confusing financial statements – and say hello to a smarter, more streamlined financial experience.

Start using Smartcredit.com today and take more control of your financial future!

How their services can help you understand your credit score and credit report

Hey there! Did you know that understanding your credit score is crucial to your financial stability?

That’s where our incredible services come in to help you out!

We make it easier for you to comprehend all in depth information about the aspects of your credit score and interpret it in terms of your financial decisions.

Not only that, but we’ll also provide you with personalized tips and tricks on how to improve it! It might seem complicated, but we’ll break it down step by step so you can feel confident in your finances.

So why wait?

Join us today and let’s work together to improve your credit score!

Reviews of SmartCredit users who have benefited from the credit monitoring service

Are you tired of constantly worrying about your credit score?

Let me tell you, Smartcredit com has been a game changer for me and many other users.

With its user-friendly interface and helpful tools, it’s no surprise that so many people have seen a significant increase in their credit score after using this service.

Not only does it make monitoring your score easy, but it also provides valuable insights and personalized recommendations on how to further improve your credit.

Don’t just take my word for it, browse through the positive reviews from satisfied users and see the difference SmartCredit com can make for you.

Benefits of using SmartCredit over other credit monitoring services

Hey there! Are you trying to monitor your credit, but feeling overwhelmed by all the different options out there?

Look no further than Smartcredit com.

With their user-friendly interface and state-of-the-art technology, Smartcredit com stands out from the competition.

Not only do they offer reliable free credit monitoring services, but they also provide tools to help you improve your credit score.

Plus, their customer service team is top-notch and always willing to help you with any questions or concerns.

So why settle for a subpar credit monitoring service when you can have the best?

Switch to Smartcredit com today and watch your credit soar!

Tips on how to optimize your credit scores with SmartCredit

Are you in the market for a new car or house?

Or maybe you’re just looking for a good interest rate on a credit card?

Whatever your reason, it’s important to optimize your credit score.

And thankfully, Smartcredit com has got you covered with some helpful credit accounts and tips.

One key tip is to keep your credit card balances low, as high balances can hurt your credit score.

Another tip is to pay up to make sure you’re paying all bills on time, as late payments can also negatively impact your credit.

By following these tips and more from Smartcredit com, you can be on your way to a better credit score and financial stability last year.

SmartCredit’s Features

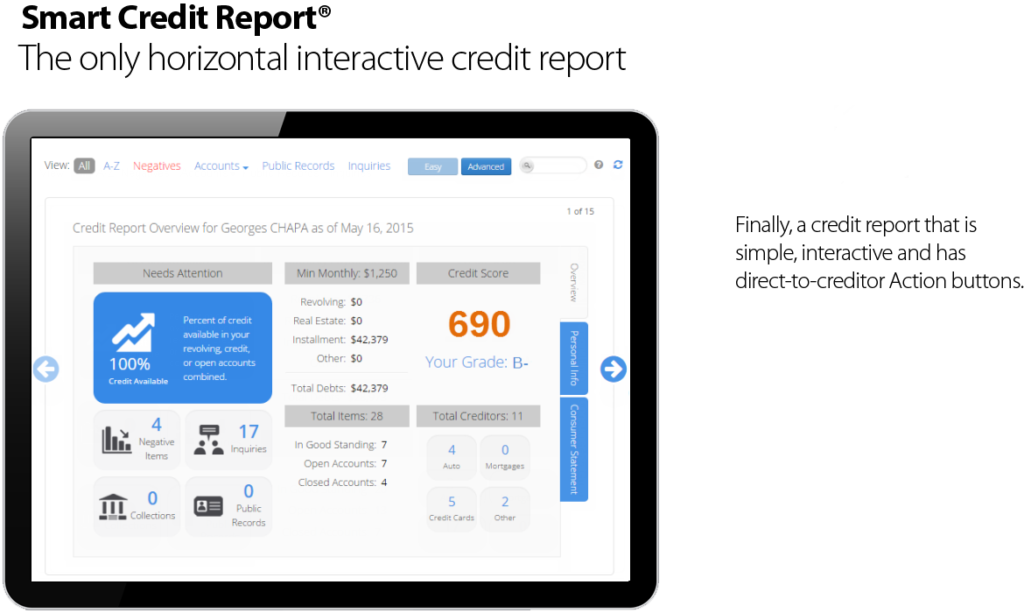

SmartCredit.com is excited to offer you a fresh and innovative way of viewing your credit report.

Their patented Smart Credit Report combines traditional credit report data with helpful money management features, making it simple and enjoyable for you to understand the impact of your daily financial decisions on your future credit score now.

Quickly Spot Spending Issues With Your Credit Reports

Have you ever noticed a higher balance on your credit card than you expected?

With their Smart Credit Report, you can click a button to swiftly review recent transactions and easily pinpoint areas to cut back on spending, helping you reduce card balances and boost your credit score.

Take Action with Ease

Their user-friendly Smart Credit Report displays an eye-catching orange “Take Action” button for each account.

By clicking on it, you’ll access a window with various handy options like requesting a higher credit limit, inquiring about specific accounts or transactions, and negotiating payment settlements.

All these actions, usually done through phone calls or lender websites, are now available in one central hub, making your life easier and saving you time.

Stay Updated on Your Credit

At SmartCredit.com, they believe in giving you real-time access to your credit report and credit scores.

Unlike some of our competitors, they don’t limit how often you can refresh your report.

Stay up-to-date and informed about your credit status whenever you want!

Convenience on the Go

SmartCredit is proud to offer a mobile app that delivers most of the features available on their other apps and website.

With just a simple button and a few taps, you can access your full Smart Credit Report, credit score, money management tools, alerts, and more, right from your smartphone.

Choose the Membership That Fits You

SmartCredit provides two tailored credit monitoring membership plans: basic and premium.

Their basic membership includes two Smart Credit report and score updates per month, unlimited access to ScoreTracker, ScoreBuilder, and ScoreMaster, five actions per month, ongoing credit monitoring and money manager usage, a la carte credit reports and scores from all three major bureaus, and up to $1 million in identity theft insurance.

Their premium membership, you’ll enjoy unlimited Smart Credit report and score updates, unrestricted use of score tracking, building, mastering, and money management tools, unlimited actions, credit monitoring, a la carte credit reports and scores, three credit reports from major bureaus, and up to $1 million in identity theft insurance.

Both memberships come with a recurring monthly fee, with the premium option being slightly more expensive.

SmartCredit Com Reviews Findings

If you’re looking to improve your credit score, you’ve come to the right place!

Our service offers a wide range of benefits that can help you achieve your goal.

Firstly, by using our service, you’ll have access to personalized credit improvement strategies that are tailored to your specific circumstances.

This means that any actions you take are more likely to have a positive impact on your score.

Additionally, our experts are always on hand to provide guidance and support, ensuring that you’re never alone on your credit improvement journey.

Finally, by consistently using our service, you’ll start to see improvements in your score over time.

In Conclusion

Smartcredit com is an a credit restoration company and excellent tool for those looking to monitor and improve their credit score.

The service provides helpful information, such as detailed insights into your credit score and report, as well as helpful tips on how to make sure it remains in top shape.

There are a variety of options available, allowing companies and you to customize the services you need.

Many users and customers have also noted that they had great success using this service when compared to others.

All in all, this is perhaps the best way to stay informed about your credit score and start making improvements where necessary.

With everything SmartCredit offers, it’s difficult not to be impressed with its features and capabilities.

Taking advantage of their insightful services will ensure that you keep your financial standing monitored and make sensible decisions that’ll benefit your future.

Ultimately, if you intend on improving your credit score then SmartCredit com might be the perfect solution!

SmartCredit FAQ

How accurate is SmartCredit?

SmartCredit.com sources its credit report data and scores from the three major credit bureaus: Equifax, Experian, and TransUnion. These three credit bureaus are well-established and reputable, ensuring the accuracy and reliability of all the information provided by SmartCredit. However, as with any credit monitoring service, the possibility of errors or discrepancies exists. It’s important to regularly review your credit reports and take advantage of SmartCredit.com’s features, such as the “Take Action” button, to dispute any inaccuracies or unrecognized charges to maintain the accuracy of your credit information.

How often does SmartCredit update?

SmartCredit offers different update frequencies depending on the membership plan you choose. With the basic membership, you receive two Smart Credit report and score updates per month. If you opt for the premium membership, you’ll enjoy unlimited Smart Credit report and score updates, allowing you to access your information as frequently as you want.

What credit score does SmartCredit use?

SmartCredit.com utilizes credit scores from the three major credit bureaus: Equifax, Experian, and TransUnion. These bureaus calculate credit scores using the FICO scoring model or the VantageScore model. While the specific credit bureau and score model used by SmartCredit.com is not mentioned, it’s important to note that scores from all three major bureaus are provided with their credit monitoring membership plans.

Does SmartCredit offer identity protection?

While SmartCredit.com primarily focuses on credit monitoring and money management features, both its basic and premium membership plans do include identity theft insurance of up to $1 million. This insurance offers a layer of protection and financial support in case you become a victim of identity theft. However, it’s important to note that identity protection services, such as monitoring your personal information for any sign of potential fraud or providing recovery assistance, may not be explicitly offered by SmartCredit.com. The site is main focus remains on credit monitoring and providing tools to help you manage and improve your credit.

What is the identity theft insurance limit with SmartCredit?

Both the basic and premium membership plans offered by SmartCredit.com include identity theft insurance coverage of up to $1 million. This insurance is designed to help protect you and provide financial support in case you become a victim of identity theft.

Does SmartCredit offer a free trial?

Based on the information available, it is not explicitly mentioned whether SmartCredit.com offers consumers a free trial for their credit monitoring and money management services. Membership options include basic and premium plans, both of which come with a recurring monthly fee. However, readers of this blog can get a 7-day trial for just $1!

Does SmartCredit affect your credit score?

No, using SmartCredit to check your own credit does not affect your credit score. This is referred to as a “soft inquiry” and does not impact your credit rating, no matter how many times you check your credit through the platform. However, it’s important to understand that “hard credit inquiries,” which occur when lenders check your credit for lending decisions like approving you for a loan or credit card, can impact your credit score. SmartCredit allows you to be proactive about your credit health and credit score without negatively affecting it. It provides tools and resources to understand and improve your credit, but it’s still essential to maintain responsible credit habits, like paying bills on time and keeping your credit utilization low.

What does SmartCredit do?

SmartCredit is a comprehensive credit monitoring service offering continuous credit monitoring and alerts for changes, access to credit reports and scores via a user-friendly interface, direct communication tools for resolving issues with creditors, identity theft protection, including up to $1 Million in identity fraud insurance, a money management tool to track spending and save money, and educational resources to better understand and improve credit scores. Essentially, SmartCredit empowers users to actively manage and improve their credit health.

How do I cancel SmartCredit?

Log in to your account at SmartCredit.com. Navigate to the ‘Settings’ or ‘Account Settings’ section of the website. Look for an option to cancel your subscription. This may be under a section labeled ‘Subscription’, ‘Membership’, or something similar. Follow the instructions provided to cancel your subscription. However, if you can’t find an option to cancel your subscription in the account settings, you should reach out to SmartCredit’s customer service. You can contact them via email, phone, or through their website’s contact form. Be sure to provide them with all the necessary details related to your account and your wish to cancel the subscription.