SmartCredit is a modern service that reimagines how credit reports are handled.

This comprehensive system free credit monitoring services aims to make the process of viewing and managing credit information much simpler and more engaging for users.

Here’s what you need to know about SmartCredit:

Overview

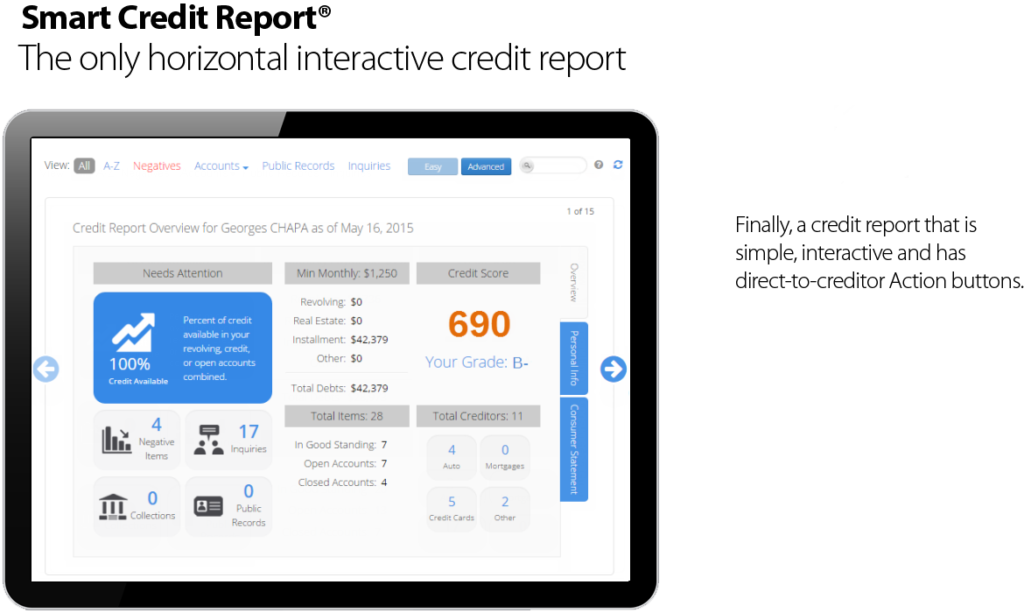

SmartCredit offers an interactive credit report that’s user-friendly and more manageable than traditional, credit bureau’ reports.

Instead of having to sift through pages of detailed account history, users and lenders can explore their credit report like flipping through the pages of a book.

SmartCredit is a credit monitoring and education company that was founded in 2003 by Michael J. Fisher, a former executive at TransUnion.

Fisher founded SmartCredit after seeing the need for a more user-friendly and affordable way for consumers to access their credit reports and scores.

SmartCredit’s mission is to “help consumers with smart credit report improve their credit scores and financial well-being.”

SmartCredit offers a variety of products, financial institutions and services, including:

- Credit monitoring: SmartCredit monitors your credit reports from all three major credit bureaus for any changes, including new accounts, inquiries, and late payments. You will be notified of any changes immediately, so you can take action to protect your credit.

- Credit reports: SmartCredit provides you with copies of your credit reports from all three major credit bureaus. This allows you to see your credit history and scores in one place.

- Credit scores: SmartCredit provides you with your credit scores from all three major credit bureaus. This allows you to see how lenders view your creditworthiness.

- Credit education: SmartCredit offers a variety of credit education resources, including articles, videos, and webinars. These resources can help you learn about credit and how to improve your credit score.

SmartCredit is a reputable company that has been in unlimited credit monitoring business for over 15 years.

It is a member of the National Association of Consumer Advocates and the Consumer Data Industry Association.

SmartCredit is also accredited by the Better Business Bureau.

If you are looking for traditional credit report as a way to track and improve your credit score and financial well-being, SmartCredit is a great option.

It is a simple charts user-friendly and affordable way to access your credit reports, scores, and education resources.

Here are some additional details about SmartCredit:

- Headquarters: Irvine, California

- Employees: 100+

- Revenue: $10 million+

- Awards and recognition: SmartCredit has been recognized by several organizations for its commitment to helping consumers improve their credit, including the National Association of Consumer Advocates, the Consumer Data Industry Association, and the Better Business Bureau.

SmartCredit Credit Monitoring Service Features

1. Interactive Tradelines

- Goodwill Requests: Send polite requests to remove items from your credit report.

- Settle Accounts: Negotiate and make an offer to clear an account.

- Mark Fraudulent Activities: Report an account as not yours or as identity theft.

- Ask Questions: Communicate directly with creditors or credit bureaus.

2. VantageScore 3.0 Access

- Helps you understand where you stand in terms of creditworthiness.

3. Various Credit Scores

- Includes traditional credit score, auto score, insurance score, and employment score.

- Offers an extensive collection of scores for different needs.

4. ScoreBoost Future Score Simulator

- Projects how specific actions might improve your credit score.

5. Additional Apps

- ScoreBuilder to boost your credit score.

- Debt Negotiator system for handling debts on your own.

Membership Levels: Sign Up For SmartCredit

Basic Membership ($24.95/month)

- Two monthly updates.

- Access to ScoreTracker, ScoreBuilder, ScoreBoost, Credit Monitoring, and Money Manager.

- Five monthly credit actions.

Premium Membership ($34.95/month)

- Includes all features of the basic membership.

- Unlimited updates and credit actions.

- Access to reports and scores from all major credit bureaus.

- $1 million ID fraud insurance.

Trial and Cancellation

- Seven-day trial available.

- Risk-free if canceled within seven days.

Who Is SmartCredit Best For?

SmartCredit is a great option for anyone who wants to improve their credit score and financial well-being.

It is especially beneficial for people who:

- Are looking for a user-friendly and affordable way to access their credit reports, scores, and education resources.

- Have had credit problems in the past and want to rebuild their credit.

- Are applying for a loan or credit card and want to make sure their credit is in good shape.

- Want to learn more about credit and how to improve their credit score.

SmartCredit is not a good option for people who:

- Only need to access their credit reports once a year.

- Are looking for a free credit monitoring service.

- Need help disputing inaccurate information on their credit report.

- Are looking for a credit repair service.

If you are not sure if SmartCredit is right for you, I recommend visiting their website for more information.

They can help you determine if SmartCredit is the right fit for your needs and budget.

Here are some of the benefits of using SmartCredit:

- Easy to use: SmartCredit’s website and app are easy to use, even for people who are not familiar with credit.

- Affordable: SmartCredit’s plans are affordable, starting at just $24.95 per month.

- Comprehensive: SmartCredit offers a comprehensive suite of products and services, including credit monitoring, credit reports, credit scores, and credit education.

- Reputable: SmartCredit is a reputable company that has been in business for over 15 years. It is a member of the National Association of Consumer Advocates and the Consumer Data Industry Association. SmartCredit is also accredited by the Better Business Bureau.

Can SmartCredit Improve My Credit Scores?

SmartCredit can help you improve your credit scores, but it is not a magic bullet.

It is important to remember that there are many factors that contribute to your credit score, and SmartCredit can only help you with some of them.

Here are some of the ways that SmartCredit can help you improve your credit scores:

- Credit monitoring: SmartCredit can monitor your credit reports for any changes, including new accounts, inquiries, and late payments. This allows you to identify any problems early on and take action to correct them.

- Credit reports: SmartCredit provides you with copies of your credit reports from all three major credit bureaus. This allows you to see your credit history and scores in one place. This can be helpful for identifying any errors on your credit report that could be dragging down your score.

- Credit scores: SmartCredit provides you with your credit scores from all three major credit bureaus. This allows you to see how lenders view your creditworthiness. This information can be helpful for making informed decisions about your finances, such as whether or not to apply for a loan or credit card.

- Credit education: SmartCredit offers a variety of credit education resources, including articles, videos, and webinars. These resources can help you learn about credit and how to improve your credit score.

In addition to these benefits, SmartCredit also offers a variety of other features that can help you improve your credit scores, such as:

- Credit score simulator: This tool allows you to see how different factors, such as paying down debt and opening new accounts, can impact your credit score.

- Credit repair: SmartCredit offers a credit repair service that can help you dispute inaccurate information on your credit report.

- Credit coaching: SmartCredit offers credit coaching services that can help you create a plan to improve your credit score.

If you are serious about improving your credit scores, I recommend using SmartCredit as a tool to help you achieve your goals.

However, it is important to remember that SmartCredit is not a magic bullet.

You will still need to make some changes to your credit habits in order to see significant improvements in your scores.

Here are some tips for improving your credit scores with SmartCredit:

- Pay your bills on time: This is the most important factor in determining your credit score. Make sure to pay all of your bills on time, in full, every month.

- Keep your credit utilization low: Your credit utilization ratio is the percentage of your available credit that you are using. Aim to keep your credit utilization ratio below 30%.

- Length of credit history: The longer your credit history is, the better it will be for your credit score. Try to open new accounts only when necessary and keep your old accounts open and in good standing.

- Request credit limit increases: If you have a good credit history, you can request credit limit increases from your creditors. This will help to lower your credit utilization ratio and improve your credit score.

- Dispute inaccurate information on your credit report: If you see any inaccurate information on your credit report, dispute it immediately. You can do this through the credit bureaus or through SmartCredit’s credit repair service.

By following these tips, you can use SmartCredit to get better score, improve your credit scores and achieve your financial goals.

The Bottom Line

SmartCredit aims to simplify the complex world of credit management.

It offers easy access to credit information and various tools to help users take more control of their financial futures.

While it lacks a more basic option for those only interested in viewing credit reports and scores, its extensive features might be worth the investment for those seeking a full-featured credit management app.

In conclusion, SmartCredit’s unique approach to credit reporting makes it an appealing choice for those looking to manage their credit in a more interactive and intuitive way.

Whether you’re looking to settle accounts, track various credit scores, see credit history or project future credit improvements, SmartCredit offers a plethora of options to cater to all your scores and needs.

Frequently Asked Questions (FAQ) about SmartCredit

1. What is SmartCredit?

SmartCredit is an innovative service that provides interactive credit reports, allowing users to understand and manage their credit information more effectively.

It presents all the information like the pages of a book, making it easier to navigate.

2. How does a Smart Credit report differ from traditional credit reports?

Unlike traditional full credit report and reports for credit inquiries that require scrolling through extensive details,

SmartCredit lets you explore information about credit card piece by piece in depth information, making it more user-friendly.

3. What actions can I take on SmartCredit?

You can send goodwill requests bank accounts, make creditors settle accounts, mark accounts as fraudulent three credit bureaus to repair, and directly ask questions to creditors or credit bureaus.

4. What types of credit scores are available on SmartCredit?

SmartCredit provides various scores such as a top score builder a top score tracker, traditional credit score, an auto top score, auto loan top builder, an insurance score, and an employment score.

5. Can I simulate changes to my credit score with SmartCredit?

Yes, the ScoreBoost future credit score score simulator lets you see how your future credit score just might change if you take specific actions.

6. What are the membership levels and their costs?

SmartCredit offers two memberships: basic at $24.95 per month and premium at $34.95 per month. The premium membership provides additional features like unlimited updates and unlimited actions made.

7. Is there a trial period for SmartCredit?

Yes, SmartCredit offers a seven-day trial for $1. If you cancel within that period, for example, you pay nothing.

8. Can I handle debts on my own with SmartCredit?

Yes, SmartCredit includes a Debt Negotiator system that helps you settle payments on debts on your own.

9. Is there a more basic version of SmartCredit for just viewing credit reports?

Unfortunately, SmartCredit does not offer a more basic version specifically for viewing credit reports and scores without additional features.

10. Does SmartCredit offer Identity Theft Insurance?

Yes, SmartCredit offers identity theft insurance as part of its credit monitoring service.

The identity fraud insurance is provided by Voyager Indemnity Company, an Assurant Specialty Property company.

The insurance covers a variety of expenses related to identity theft protection, including:

- Fraudulent charges on your credit cards

- Costs associated with disputing fraudulent charges

- Costs associated with repairing your credit report

- Costs associated with replacing your driver’s license or passport

- Costs associated with hiring a lawyer to represent you in an identity theft case

The insurance also includes a $1 million identity theft insurance policy that covers your legal expenses, lost wages, and other financial losses.

To be eligible for the insurance, you must be a member of SmartCredit’s credit monitoring service and have a valid credit report.

You must also be a resident of the United States.

The insurance is not available in New York or Texas.

The cost of the insurance varies depending on the plan you choose.

If you are concerned about identity theft, I recommend considering SmartCredit’s credit monitoring service with identity theft insurance. It is a comprehensive and affordable way to protect yourself from both identity fraud and theft.

Here are some additional details about SmartCredit’s identity theft insurance:

- Coverage: The insurance covers a variety of expenses related to identity theft, including fraudulent charges on your credit cards, costs associated with disputing fraudulent charges, costs associated with repairing your credit report, costs associated with replacing your driver’s license or passport, and costs associated with hiring a lawyer to represent you in an identity theft case.

- Deductible: There is no deductible for the insurance.

- Limits: The insurance has a $1 million limit for identity theft expenses.

11. How do I access the $1 million ID fraud insurance?

This feature is included free in both membership levels, but activation is required to sign up for the fraud insurance benefit.

12. Is SmartCredit suitable for everyone?

While SmartCredit provides a unique and comprehensive set of features, it may not be suitable for those only using smart credit or wishing to view their credit report and scores without all the features extra features.

For a comprehensive look at SmartCredit read our SmartCredit Reviews.